The 8th Airline & Travel Payment Summit Asia-Pacific will take place from August 27-29 in Penang, Malaysia. On the first day of the main program I’ll moderate the panel discussion on: “Industry regulations: from NDC to PSD2 and their impact on Payments & Fraud”.

As part of a series of articles around the above mentioned topic, this time an alternative perspective on Open Banking payments. But let’s start with a definition: “Open Banking is a brand new, secure way for consumers including small businesses to share information, allowing new and existing companies to offer super-fast payment methods and innovative banking products. It has the power to revolutionise the way we move, manage and make more of our money.”

When it comes to the actual payments, under the hood Open Banking might be new, but consumers paying for goods and services on the Web by making use of online banking started already in the Nordics during the early 2000’s, shortly after followed by other “bank-based” countries like Germany and the Netherlands. It was KLM that started to offer online banking first in 2005, shifting some 25% of the bookings in their home market from credit cards to iDEAL on day 1 (yes, they also introduced a credit card surcharge that same day). Next to avoiding the surcharge, it also enabled customers not in possession of a credit card or feeling insecure to use it online, to pay with their bank account in real-time (a feature that was not supported by regular “offline” bank transfers and direct debits). Since KLM pioneered with offering online banking (and a range of other local / alternative payment methods), other airlines followed by connecting to local banks and/or aggregators like Sofort (Klarna) and Trustly, with good results in traditional debit oriented countries (in contrary to credit markets like in the UK and the US).

Much has been written about the upsides for Airlines when offering Open Banking to their customers and successfully cannibalizing the share of wallet of credit cards, in summary:

- Different pricing model, resulting in a significant reduction in processing costs

- Non reversible (for fraud or other reasons), creating a saving in operational and chargeback related costs

- Grow (online) sales, reaching customers that prefer to pay directly from their bank account

- No deposit or hold back requirements for covering the time between booking and departure

- In case of Instant payments, improved cash flow

Without a doubt all very strong points from an Airline perspective but it’s all theory if customers do not select and successfully check out with Open Banking, especially the ones now paying by credit card. So it’s all about adoption, what’s in it for the customer? What kind of scenarios will have to be considered? First of all the customer needs to be aware of the product, recognize the brand and ideally has used it before with a positive user experience. It should not be the airline promoting the product to create brand recognition! So consumer marketing by the individual banks of the “domestic scheme” would help. What else will play a role from a customer perspective, especially in card centric countries (and let’s not get fuzzy with the mobile experience of millenials!)?

- Cash flow, money leaving the customer’s account instantly is not a selling point! Recently, next to existing payment terms on credit cards there’s a trend towards delayed or installment payments, Open Banking is heading in the opposite direction

- Dispute rights, not every single airline will have a triple AAA rating and recent bankruptcies have fuelled concerns about non reversible payment methods for Airline direct bookings that are not covered by consumer protection schemes. Should airlines consider bundling Open Banking with travel insurance?

- Stickiness, card issuers offer their card holders all kind of perks (think about the miles earned on the airlines’ own co-branded cards) and services like travel insurance. Currently these loyalty schemes do not exist (yet) for Open Banking

- Spending limit, unlike most cards the spending limit for Open Banking is typically directly related to your account balance, which might make it easier to pay from your bank account (also if you’d like to keep your spending limit for payments once arrived at the destination)

- There’s no surcharging allowed for consumer cards in Europe but this same PSD2 regulation also prohibits offering discounts on other forms of payment. How to incentivize Open Banking?

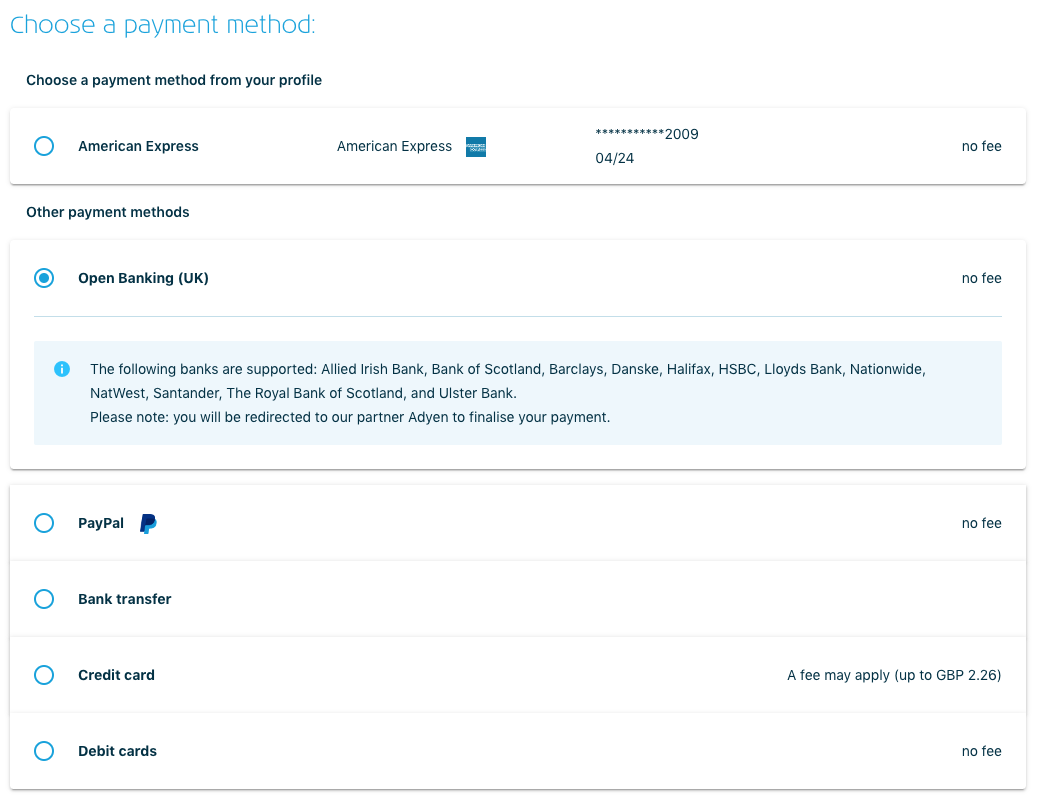

- Positioning, like in the above screenshot from the KLM website, placing the airline’s preferred payment method at the top of the payment page, using clear instructions, will help the conversion

In conclusion, Open Banking definitively has the potential of disrupting the traditional payment landscape and bring advantages to the airlines. To get there however, the customer perspective has to be taken into consideration. Pretty sure that there are other angles, so as always I welcome your feedback!

Interested in more Airline & Travel payment related information and updates? Follow Up in the Air‘s company page on LinkedIn.