Airline Payments – Demystifying Foreign Exchange, a new Up in the Air – Travel Payment Consultancy infographic, in collaboration with Maarten Rooijers’.

Is FX the last remaining ‘black box’ in payments? In a global, cross border market like Travel, FX plays an important role in both B2C (customer) and B2B (supplier) payments. Handling multiple currencies introduces (process / system) complexity, (volatility) risk, (fixed and variable) costs, but also opportunities. It’s important to note that FX is not only a cost center, it can also be a profit center when a choice is offered to the customer to check out in their preferred (local) currency and form of payment.

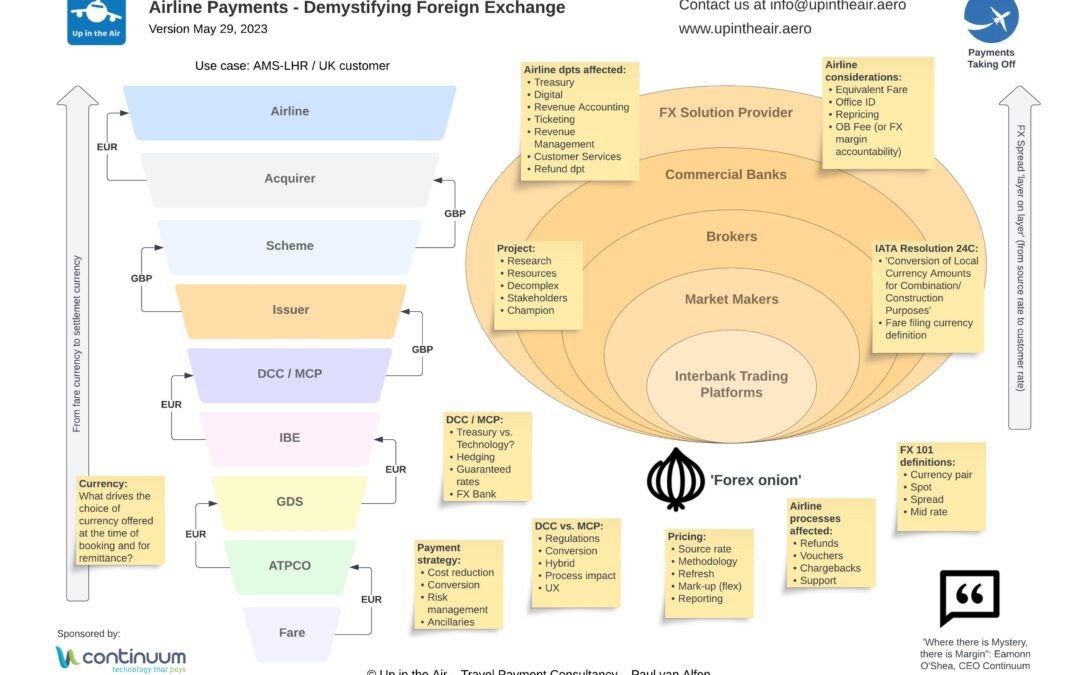

In this infographic we try to summarize the FX related factors that play a role for (incoming) Airline payments, including the ‘currency journey’. How is the currency determined for an individual booking, all the way from the original (‘filed’) fare to receiving the funds from the acquirer? Also included, the ‘Forex onion’ describing the multiple steps (‘layers’) from the source rate (think ‘Reuters’) to the rate available to end users like corporations and consumers.

But first some remittance related ‘card payments FX 101’:

☑️ Cross border acquirers can accept payments for authorization in a wide range of currencies

☑️ Acquirers can remit funds to merchants ‘like for like’ in a limited number of ‘regular’ currencies (typically 14-17). Other currencies are converted at the time of settlement to an agreed base currency (e.g. USD or EUR). Merchants can also opt to receive some (or all) of the regular currencies in their base currency

☑️ For this conversion the acquirer uses its own methodology; source rate, timing, refresh frequency and applies a spread / mark-up (covering both risk and margin), typically described in the merchant agreement

The above mentioned process for ‘remittance FX’ leads to costs but what about generating revenue on the front-end? Dynamic Currency Conversion (DCC) and Multi Currency Pricing (MCP) solutions can help to improve (look to book to pay) conversion as it enables the customer to pay in the currency of their choice. In case the payment currency is different from the card holder currency, it’s the issuer that will convert the amount and add a margin. This margin can be made by the merchant when DCC and/or MCP are applied. For an airline, assessing and implementing these solutions requires an in-depth understanding of the impact on processes, reporting and customer experience.

We do realize that FX is a complex (and for most of us, mostly hidden) topic and therefore creating awareness about it for a wider group of airline payment professionals with this infographic, is just a start. For a deep-dive into this topic, contact Maarten who has hands-on experience on the airline side with both Treasury and MCP.

Special thanks to Eamonn O’Shea at Continuum Commerce Solutions for sponsoring this infographic.