It’s now nearly 20 years ago that I started my first implementation of a range of APM’s (Alternative Payments Methods) to support the growth of the online channel for a pioneering global airline. It was a long and steep learning curve, as all existing processes were based on ‘16 digits’ (card numbers and characteristics) and needed to be adapted to work with e.g. one step, indirect, push and asynchronous forms of payment based on bank accounts, eWallets and Cash. From the checkout page to fulfilment, support, refunding, dispute management, reporting, reconciliation, currency conversion, settlement, contracting, partner management and invoicing, it all needed a new approach.

Fast forward to today and alternative / local forms of payment methods have picked up in all regions, with products supported by country, channel, demographic and type of business (e.g. gaming/gambling has its own specific wallets). The adoption differs very much on (a.o.) the local payment culture, existing payment infrastructure, merchant acceptance, user experience and the incentives provided to the customer. Payment gateway, orchestration and service partners have added APM’s to their menu to simplify the integration and speed up the time to market for merchants.

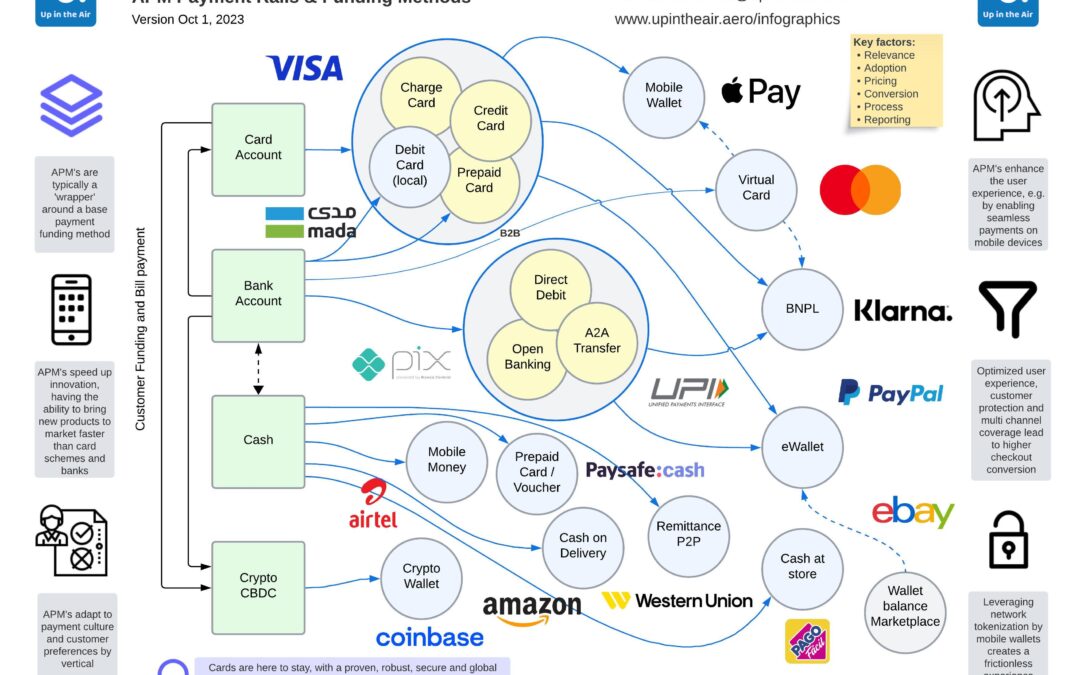

In this infographic I try to shed some light on the underlaying payment rails for APM’s, how does the customer actually fund the APM used for a purchase or remittance? In the UK, it is for instance not allowed to settle your credit card bill with another credit card, therefore an ideal opportunity to leverage Open Banking for online bill payment! A wallet like PayPal can be funded by card, direct debit and account balance (especially relevant for marketplace sellers). The layering means that in most cases APM’s are not replacing cards (in case of e.g. mobile wallets) or bank accounts (on case of e.g. BNPL and Crypto), these merely move into the background as funding methods. Comparing market shares between Visa, Mastercard and Apple Pay therefore does not make sense (only as payment mechanism), that’s ‘apples and oranges’ 😉!

PS. The product names / companies mentioned in the infographic are just examples to clarify the APM categories.