To wrap up my review of the main Airline and Travel payments related trends in 2022, next up is Open Banking Payments.

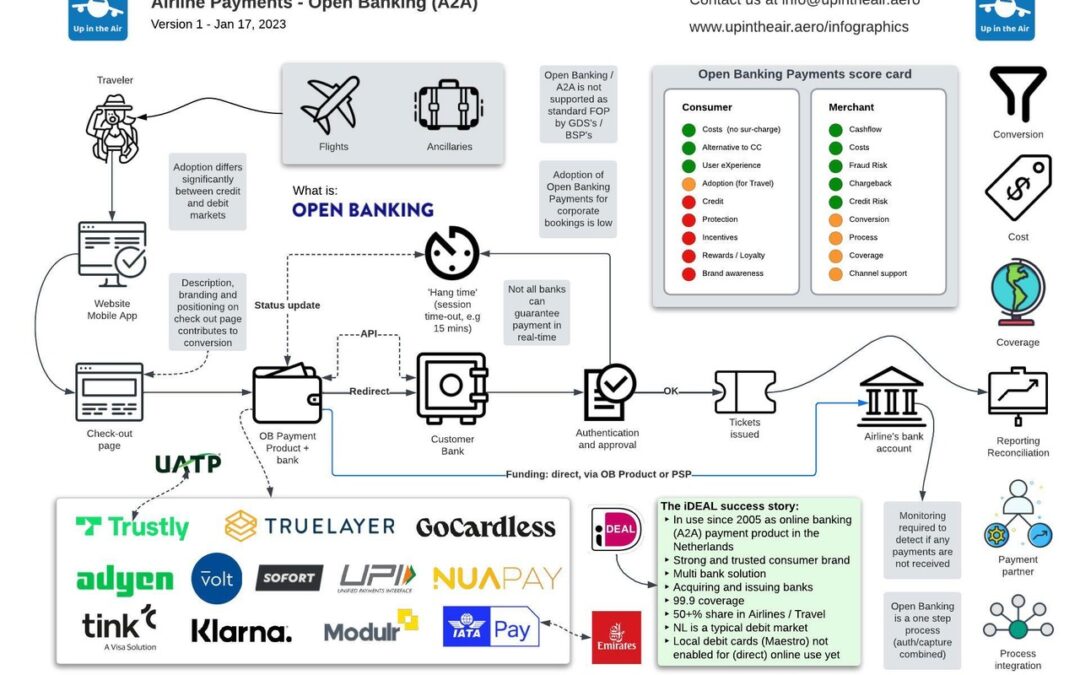

‘Open Banking’ addresses a wide range of factors that play a role in Airline payments, to mention a few:

☑️ Channel shift, it allows customers who don’t own a card or have insufficient spending limit, to pay directly from their bank account

☑️ A real-time confirmation allows payments for bookings closer to the departure date, compared to offline bank transfers

☑️ Open Banking products cover a wide range of banks (multi bank vs. more traditional single online bank solutions), typically in multiple countries

☑️ Cashflow, as bank transfers cannot be reversed, no holdbacks are required and collected funds can be remitted shortly after the transactions have taken place

But it also introduces some operational challenges and currently lacks the built in incentives required to shift existing credit card users to this merchant friendly form of payment. Open Banking has proven to be very effective for many payment use cases, from bill payment to retail and gaming/gambling. To cover the specific customer needs for Airline and Travel bookings and drive adoption, Airlines and vendors will need to add value and protection though, in order to create a level playing field with the dominant card brands and wallets.

In this infographic I try to summarize the process, factors and the main vendors (for Airlines). Also included is a ‘mini score card’ to widen your view on this alternative form of payment.

Special thanks to Maarten Rooijers, who is a subject matter expert and pioneer in Airline payments including Open Banking and BNPL, for his input and feedback.