In August of last year I published an article on IATA’s Transparency in Payments (“TIP“) as part of my series about the impact of standards and regulations on Airline payments. It gave a quick look at the B2B channel and the impact of TIP on Travel Agents selling tickets on behalf of airlines. With the first B2B Airline & Travel Payment Summit coming up next month in London, I’m hereby sharing it again with some additional information and 2020 updates included.

Let’s start with IATA’s definition: “Transparency in Payments (TIP) is an industry initiative focused on providing airlines with increased transparency and control in the collection of their sales through the travel agency channel. At the same time, it will enable travel agents to take advantage of new forms of payment for the remittance of customer funds”.

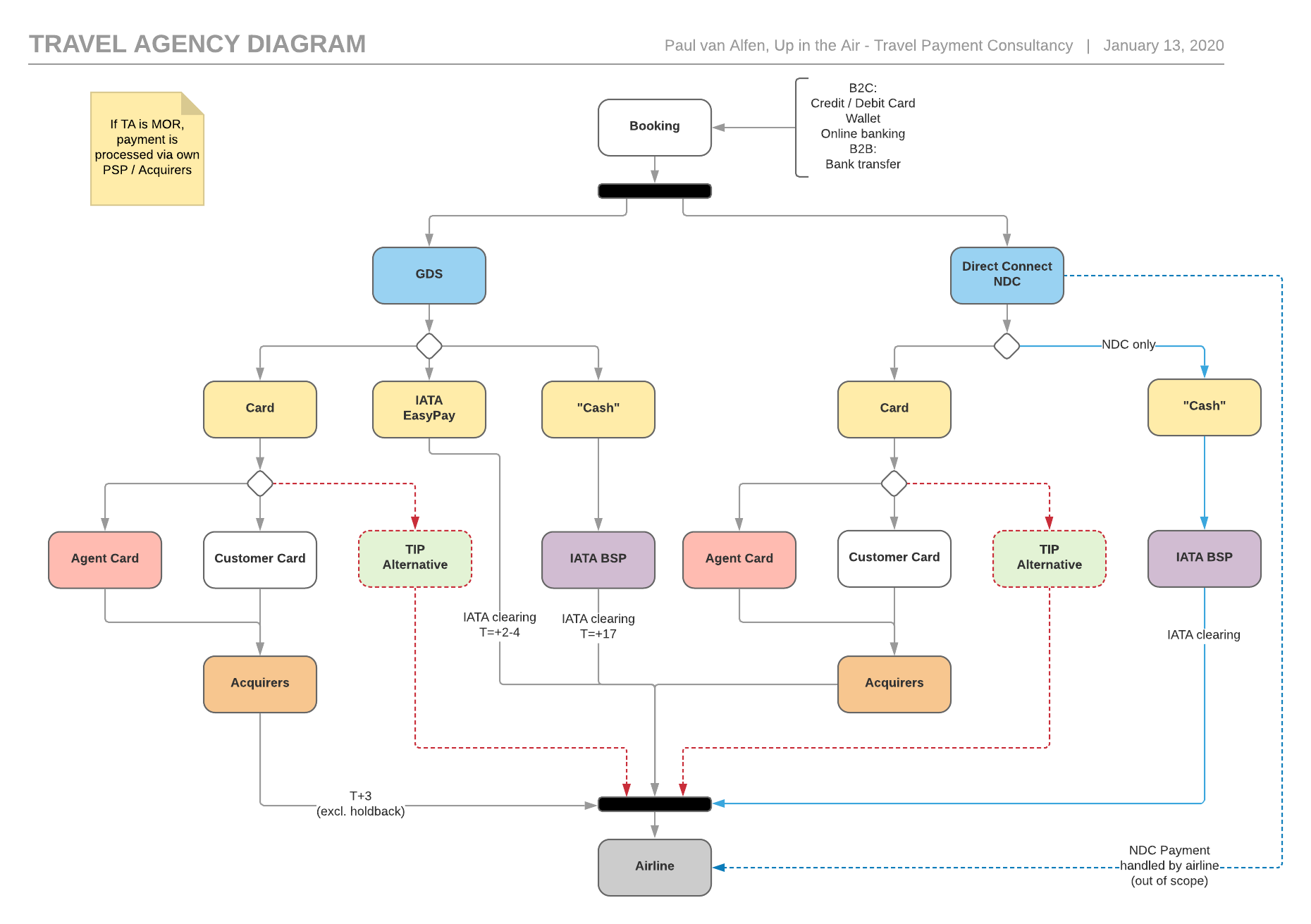

As mentioned in my article on payments for NDC, travel agents pay airlines for bookings made via the GDS’s predominantly by “BSP Cash” and “BSP Card”. Under IATA’s resolution 890, until NewGenISS, the agent was technically only allowed for “BSP Card” to pass on the customer’s card details (like for like). In practice however agents in many cases decoupled the “pay-in” (customer payment) from the “pay-out” (remittance to airline) and inserted their own corporate card or virtual card in the booking to create flexibility, boost sales, optimize processes, manage the cash flow and in case of virtual cards, generate a revenue stream. The routing options are visualized in the diagram below:

Some specific OTA sample use cases that add value and help to bypass restrictions in place due to the legacy set-up of the GDS’s:

- Accept a single payment for a booking that includes multiple suppliers

- Accept a consumer payment in a different currency than the fare in the GDS

- Accept a (local / alternative) form of payment not supported by the GDS

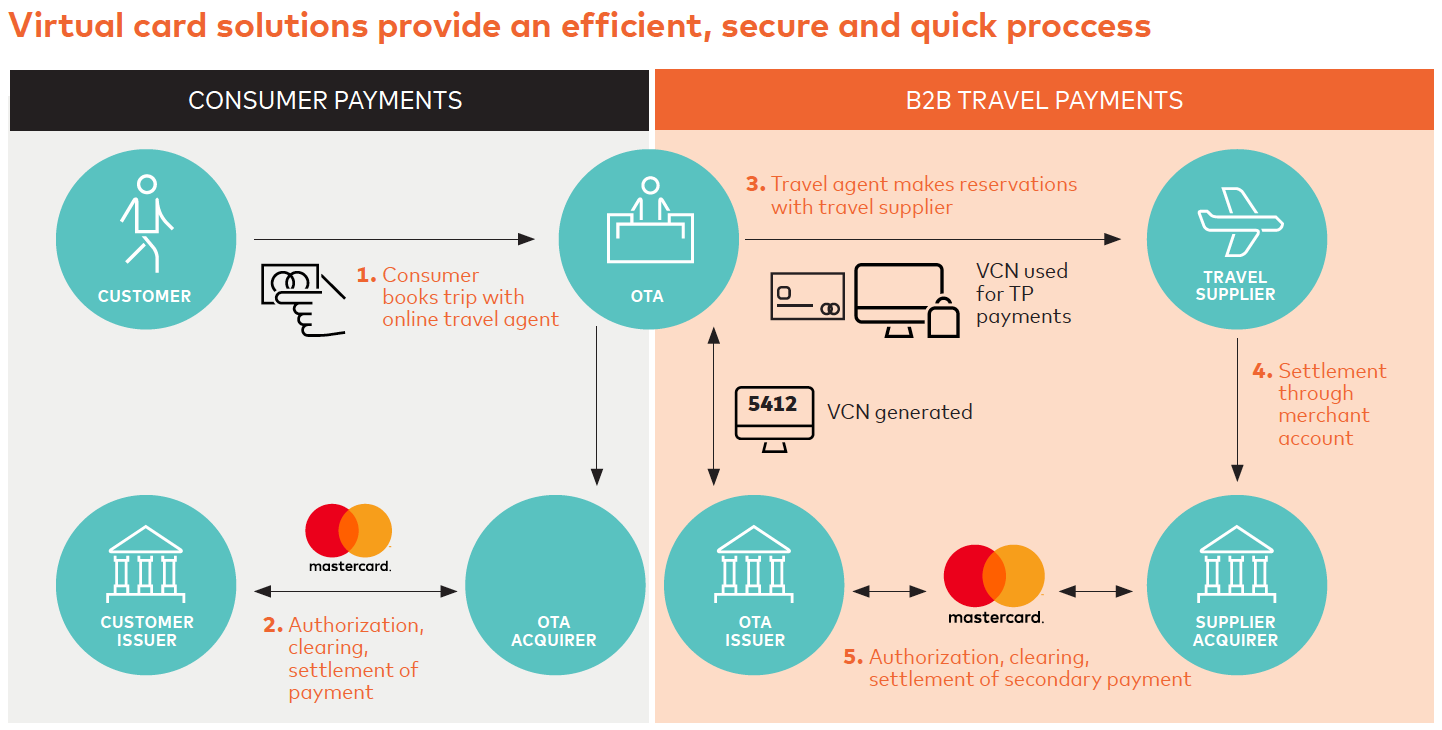

For (a.o.) the above mentioned use cases, a travel agent could generate a virtual card (VCC) on the fly and insert it in the booking, replacing the customer payment. The VCC will then be processed via the existing “BSP card” flow, the main difference typically being that transactions attract higher interchange costs (which are partially shared by the issuer with the travel agent), but VCC’s for instance also protect the agents against losses due to airline bankruptcies.

How does the VCC process work?

Source: Mastercard article “B2B travel payments: It’s time to improve the experience” on PhocusWire (click on link for full article). See also LinkedIn posts on this topic by Chiara Quaia, Mastercard’s VP Travel.

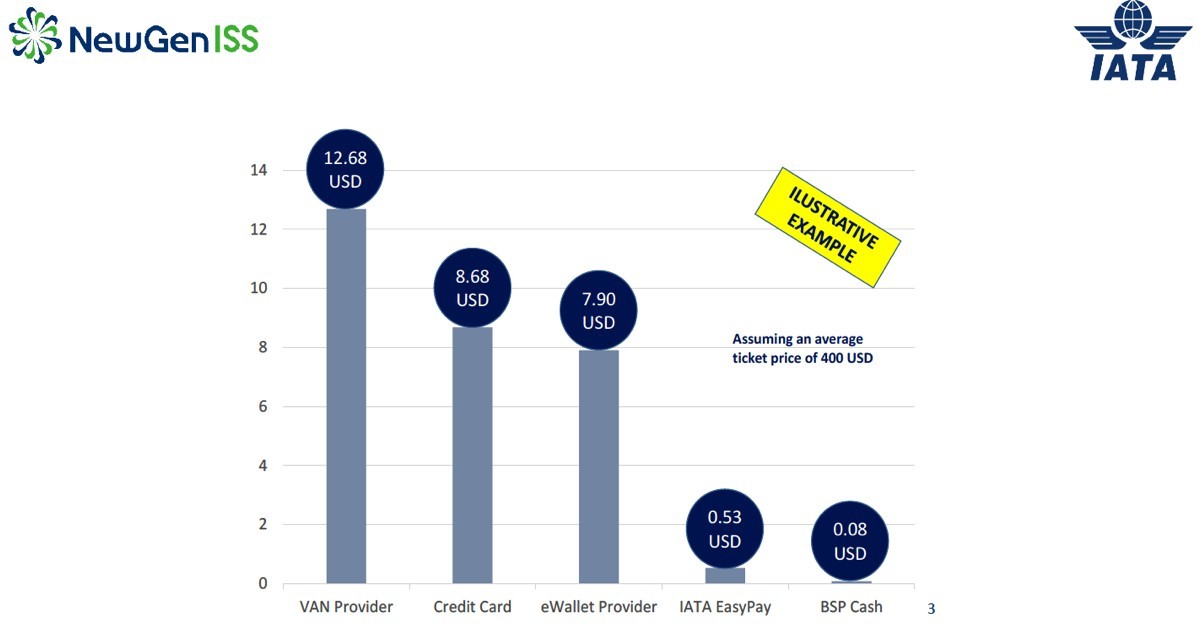

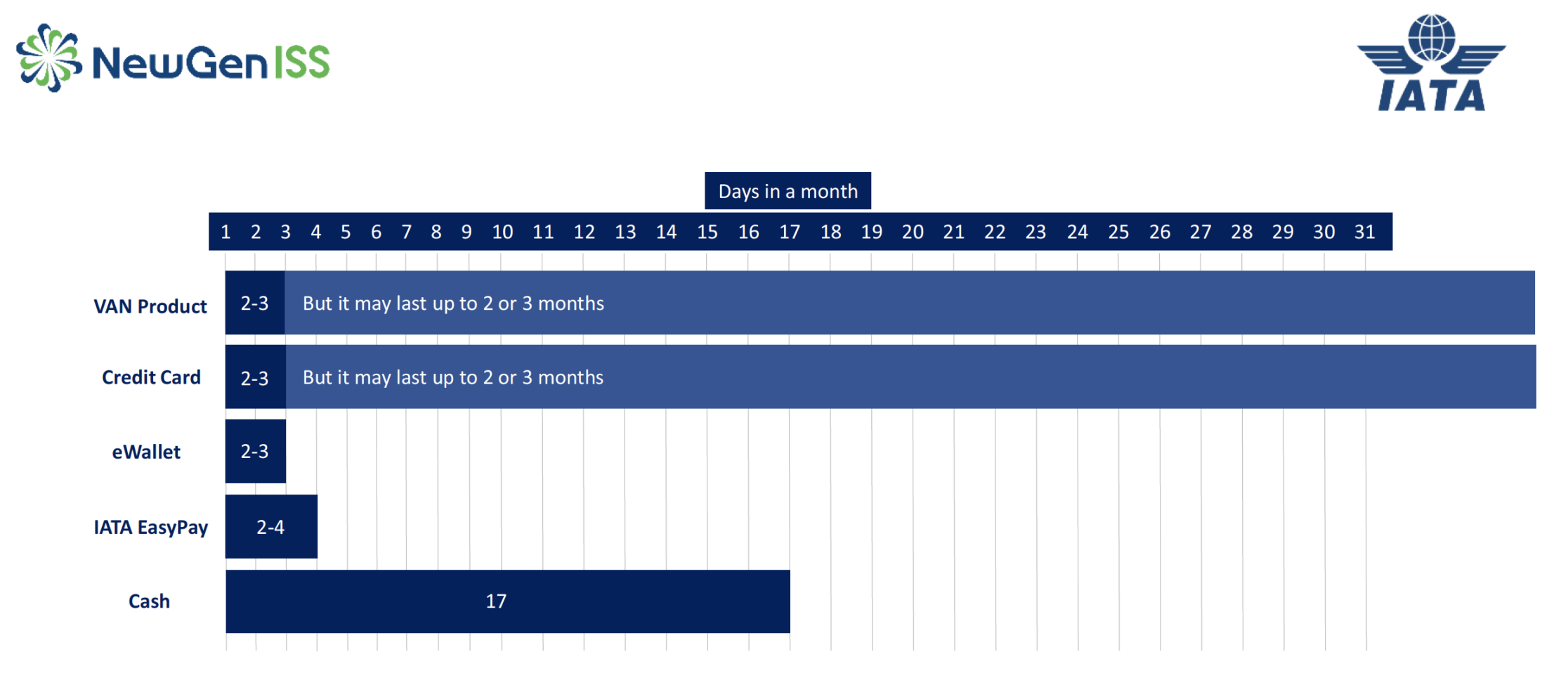

Under the new resolution 890 agents are now allowed to insert “their own card” (VCC, corporate card) as long as they come to a bilateral agreement with the airline, mainly about the costs. As you can see from the below comparisons, from an airline point of view, there’s quite a difference between the available options, whereby there’s in some cases a correlation between costs and speed of payment (impact on cash flow). Next to these 2 factors also e.g. agency default risk, fraud, data breaches, reporting / reconciliation, global coverage and impact on operational processes will need to be considered (see above mentioned Mastercard article):

Source: IATA NewGenISS Airline Readiness Guide which can be downloaded from: https://newgeniss.iata.org/airlines/resources/

The challenge for the vendors active in this space is now to help the airlines and agents with products that strike a balance between (incentivizing) sales, (lowering) processing costs and (improving) speed of payment, but are also scalable and relatively easy to implement / roll out without disturbing the legacy processes that have been in place in some cases since the introduction of BSP in 1971. The airlines will have to enter into discussions with the 20% of the agents that bring in 80% of the volume, knowing that some of the airlines are currently completely blocking the use of VCC’s by agents and now have an option to reconsider their (indirect) distribution strategy.

Aran Brown, CEO of Ixaris Group “OTAs have traditionally seen payments as something that just needs to be kept ticking over, with little strategy or expertise placed in the function. However, the more sophisticated OTAs are starting to use payments strategically and – in many cases – it’s becoming as important to a business’s performance as data. As we look ahead to 2020, we’ve identified three trends that OTAs will face (cost of credit, ease of experience and play your cards right) – all of which relate directly to payments, and all of which can be mitigated with a strategic approach to payments optimisation.”

Source: Ixaris article “How payments can help OTAs stay ahead in 2020” on Travolution (click on link for full article)