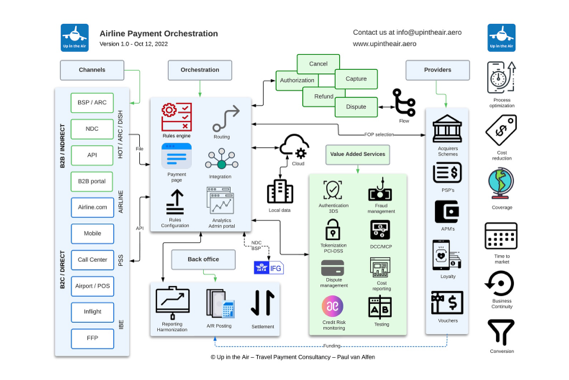

Payment Orchestration Providers offer airlines an outsourced, multi channel, PSP/Acquirer agnostic layer that helps (a.o.) to reduce time to market, to improve business continuity and to create commercial leverage. This “Payment Hub” typically comes with a rules engine, dynamic routing capabilities, connections to multiple global and regional gateways, acquirers and products. As icing on the cake (scheme) tokenization across providers is added to complete the solution.

When online payments started taking off in the early 2000’s, merchants first looked at their banks to help them out. As these banks were vast asleep, young tech companies stepped in to provide online payment gateway services like connections to acquirers, hosted payment pages, real-time authorizations and basic fraud screening, creating the first generation of payment gateways. These providers started to add basic routing capabilities (to enable the use of multiple acquirers) and support for alternative / local forms of payment, 3D secure and more sophisticated fraud management solutions later during that decade. With e-commerce maturing, becoming omni channel and large merchants more and more going global, the payment related requirements started to exceed what a single gateway provider could offer to a growing portfolio of diverse merchants, triggering the need for a new generation of payment orchestration providers.

Running a payment operation for an Airline is like juggling with (too) many balls, you’ll have a long list of objectives to cover; business continuity, costs, risk, conversion, time to market, user experience, cashflow, customer service, (data) security and compliance, to mention “a few”. Multiply this with the number of channels / touch points and many potential pain points will arise. To streamline payment processes and to improve end to end controls, an orchestration layer can help to fight challenges like lack of flexibility, long time to market, geographical coverage, high costs and low conversion rates.

Orchestration middleware can also be used for load balancing, spreading transactions over multiple providers / acquirers to honor volume commitments, risk exposure related volume caps and to anticipate on tiered pricing.