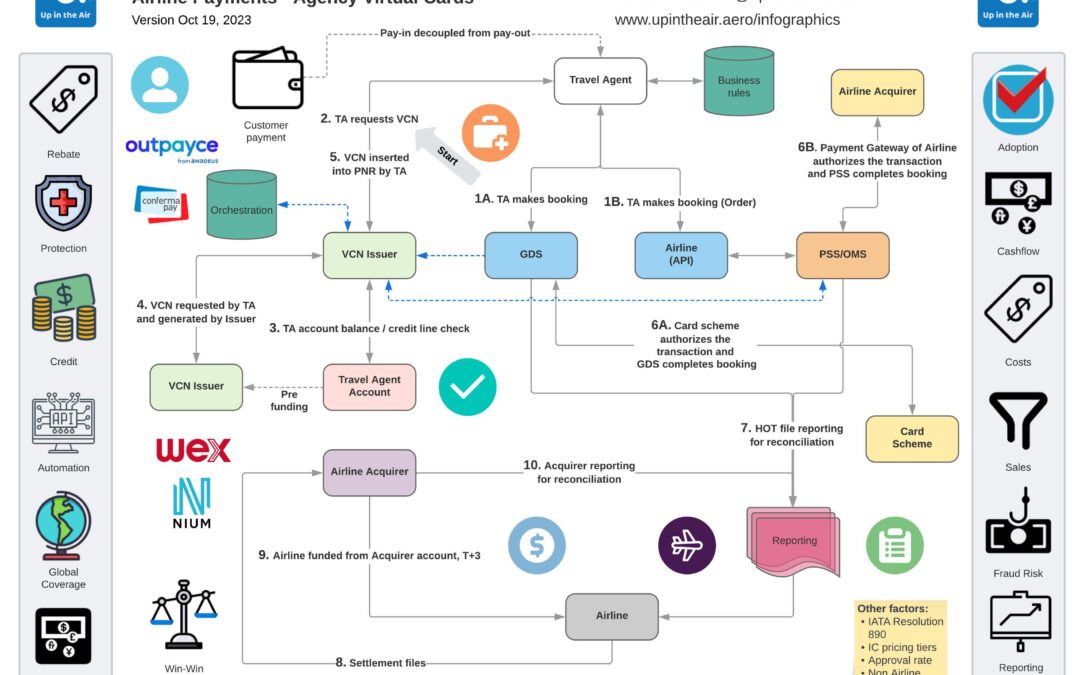

During the recent Indirect Sales Summit / World Aviation Festival in Lisbon, I moderated a panel on ‘Consumer payment trends and the impact on B2B payments’, basically covering the difference in payment innovation between B2C (‘pay-in’) and B2B (‘pay-out’). It’s fair to say that the developments in consumer payments move way too fast for the legacy travel industry (B2B) payments infrastructure to keep up. For product innovation, using existing card rails will therefore the best solution for the foreseeable future. This brings us to the popular topic of VCN’s (or VCC’s), how do they fit into the booking and payment processes and what are the pros and cons, from both the seller and supplier perspective? This time an ‘old school’ flow chart to walk you through the process, by following the numbered steps.

Some background; when a Travel Agency acts as retailer and becomes MOR (Merchant of Record), the pay-in by the customer is decoupled from the pay-out to the airline. This in contrary to the agency model, where customer cards are used for a pass-through and the intermediary plays no active role in the money flow (other than collecting a booking fee separately).

Under IATA’s resolution 890, until NewGenISS, the agent was technically only allowed for “BSP card” to pass on the customer’s card details (like for like). In practice however agents in many cases inserted their own corporate cards or in real-time generated virtual cards in the booking to create flexibility, optimize processes and in case of virtual cards, a revenue stream.

Under the most recent resolution 890X (896, 812A), agents are allowed to insert “their own card” (VCN, corporate card) as long as they come to a bilateral agreement with the airline, mainly about the costs (also known as ‘Transparency in Payments’). When solely focusing on direct costs, from an airline point of view there’s quite a difference between the available options, whereby there’s in some cases a correlation between costs and speed of payment (impact on cash flow). Next to these 2 factors also the impact on sales, agency default risk, reporting / reconciliation, global coverage and operational processes will need to be considered. See my B2B score card infographic in the comments for more details (or go to: https://upintheair.aero/infographics/).

The challenge for the vendors active in this space is to help the airlines and agents with products that strike a balance between (incentivizing) sales, (lowering) processing costs and (improving) speed of payment, but are also scalable and relatively easy to implement / roll out without disturbing the legacy processes that have been in place in some cases since the introduction of BSP in 1971. Next to this there’s room for innovation, using a sandbox to try out alternative solutions based on blockchain, A2A and market places. Scaling these up to a global solution will however take time, as nothing in the airline and travel industry happens overnight, due to the dependencies on the many links in the chain and the need for a robust, sustainable and compliant processes.

PS. the companies mentioned in the infographic are just examples to clarify the process steps.